Subscribe for More

Cleveland, OH, February 17, 2025 - MCM Capital Partners (“MCM”), a lower middle market private equity firm, is pleased to announce the sale of Zinkan Enterprises, rebranded as ChemREADY (“Zinkan”), a leading provider of chemicals, equipment, and services used for maintaining safe and compliant water quality processes to Plexus Capital, headquartered in Charlotte, NC. This...

DENVER, CO – AIM Processing, with support from MCM Capital Partners, has acquired Technical Molded Products, a move that solidifies AIM's position as one of the leading injection molders serving manufacturers in the western United States. This strategic acquisition enhances AIM's capabilities and expands its customer base in key industries. AIM Processing, which specializes in...

MCM Capital Partners (“MCM”), a lower middle market private equity fund, is pleased to announce the sale of RMB Products (“RMB”), a precision manufacturer of highly engineered thermoplastic components utilizing rotational molding, rotational lining and 3D printing processes. RMB nearly doubled both revenues and EBITDA during our partnership, resulting in an attractive outcome for MCM,...

Discussion of lower middle market deal activity in 2023 and 2024 amid today's rising interest rate environment

MCM Capital Partners (“MCM”), a micro-cap private equity firm based in Cleveland, Ohio, is pleased to announce its recent acquisition of AIM Processing based in Longmont, CO. AIM Processing is a custom plastic injection molder specializing in small, tight-tolerance parts and are experts in overmolding, insert molding, and metal replacement serving the medical device, industrial,...

Cleveland, OH –MCM Capital Partners (“MCM”), a micro-cap private equity firm based in Cleveland, Ohio, is excited to announce the majority recapitalization of Tech NH, Inc. (“Tech” or the “Company”). Tech, based in Merrimack, New Hampshire, is a technical injection molder serving the medical device, general industrial, defense and green energy industries. Founded in 1982...

As a private equity fund focused on lower middle market manufacturing and distribution businesses, we are often asked about our eventual plans to sell portfolio companies. Private equity investors typically have a planned investment horizon (typically 5-7 years) during which they expect to hold, grow and exit a portfolio company. However, the exact timing of...

Partnering with a private equity fund is sure to have a transformative effect on any business. Gaining clarity on these topics will help determine whether a private equity suitor can be a potential long-term growth partner.

MCM Capital Partners (“MCM”), a lower middle market private equity fund, is pleased to announce the sale of Performance Plastics (“PPL”), a precision injection molder of highly engineered thermoplastics. PPL doubled revenues and more than doubled EBITDA during our partnership, resulting in an attractive outcome for MCM, its shareholders and the PPL management team. “Over...

FOR IMMEDIATE RELEASE - March 10, 2022 - MCM Capital Partners (“MCM”), a lower middle market private equity fund, is pleased to announce the sale of Torsion Group Corp (“TGC”), a vertically integrated manufacturer and distributor of garage door parts and accessories, to Kaulig Capital. The transaction resulted in an attractive outcome for MCM, its...

Cleveland, OH, April 26, 2021 - MCM Capital Partners (“MCM”), a lower middle market private equity fund, is pleased to announce the sale of First Impression Ironworks (“FII”), a vertically integrated designer, manufacturer and installer of custom ornamental ironwork including decorative security doors, iron entry doors, gates, staircases, rails and other custom iron products. MCM...

It is with a heavy heart, we announce the passing of Mal Mixon, long-time mentor, friend and one of MCM’s founders.

June 2020 – Torsion Group Corp (“TGC”) is a manufacturer and distributor of garage door parts and accessories. For the past few years, one of TGC’s strategic initiatives has been vertically integrating to bring more manufacturing inhouse, giving the company more control over its supply chain while enhancing profitability. To that end, TGC purchased a...

An unexpected economic downturn can alter a business owner's exit planning timeline. Fortunately, a multitude of options exist to bridge valuation gaps when they arise.

Determining the value of a business is far from a straightforward discounted cash flow calculation. Regardless of whether a business owner relies on themselves, their management team, or a third party appraiser for conducting a business valuation, the exercise requires a thorough examination of the company's balance sheet, customer base, growth prospects, intangible assets, and...

MCM recently launched an interview series designed to help business owners better navigate the M&A process. Ever few weeks, our team will be interviewing business owners, capital investors, lawyers, accounting, tax, and other M&A professionals involved in buying and selling privately owned businesses. The series will cover topics ranging from business owner advice and experiences...

MCM is pleased to announce the addition of Chris Hren as Business Development Officer. Chris’s responsibilities will include managing the firm’s deal sourcing, origination, and marketing initiatives. Prior to MCM, Chris worked as a Business Development and Marketing Manager at a specialty paint and coatings manufacturer. Chris graduated Cum Laude from Case Western Reserve University...

Cleveland, OH – MCM Capital Partners (“MCM”), a micro-cap private equity firm based in Cleveland, Ohio, is pleased to announce the majority recapitalization of EB Industries (“EBI” or the “Company”). EBI, based in Farmingdale, NY, is a highly specialized electron beam and laser welding service provider for demanding applications in the aerospace, medical device, semiconductor and...

Has the keg gone dry? Back in my (much, much) younger days I enjoyed a good party and had the staying power of a marathoner to last well into the wee hours. However when the keg went dry it was time to head home. I believe we are in the part of the economic cycle...

August 2019 – RMB Products rotomolds, rotolines and 3D prints critical components used in commercial and defense aerospace, semiconductor, biopharma and chemical applications. Within the last year RMB has made substantial capital investments in all manufacturing areas, including the addition of two new EOS 3D printing workstations with automated powder handling in a closed loop...

August 2019 – Torsion Group Corp (“TGC”) is a manufacturer and distributor of garage door parts and accessories. After launching the company’s online ordering capability six months ago, Torsion Group Corp (“TGC”) solidified its presence in the online retail space by acquiring North Shore Commercial Door (“NSCD”), a pioneer in the online garage door parts and accessories...

May 2019 – Performance Plastics (“PPL”) is world class technical injection molder focused on highly engineered components. Many of PPL’s molded parts need to maintain exacting dimensional tolerances which are difficult to measure with the standard QC equipment. To better serve its customers and further differentiate itself from other molders, PPL made a significant capital investment by...

"What is the value of my business?" This is a common question asked by business owners for estate planning or retirement purposes since, in many cases, most of their wealth is tied up in their company. Establishing a company's true value requires soliciting bids from qualified buyers. However, short of putting your company up for...

Cleveland, OH – MCM Capital Partners (“MCM”), a micro-cap private equity firm based in Cleveland, Ohio is pleased to announce the majority acquisition of Andover Corp. (“Andover” or the “Company”). Andover, based in Salem, NH, is a leading manufacturer of highly engineered, thin film optical coatings and filters for aerospace and defense, semiconductor, environmental, medical device, astronomy and...

Imagine sitting at the final table of the World Series of Poker. The first hand has just been dealt and you occupy a cushioned seat sandwiched between Doyle Brunson on your right and Johnny Chan on your left. You carefully take a peek at your hole cards and immediately see pocket jacks and your heart...

At MCM Capital Partners my primary responsibilities include direct sourcing of investment opportunities and managing intermediary relationships within the investment banking and buy-side intermediary community. As a result, I am thrust into the realm of networking: cocktail parties, dinners, golf, conferences, etc. Nowadays, it even entails online networking - blogging, LinkedIn, FaceBook, and Twitter. My...

Generally speaking, the economy is firing on all cylinders as evidenced by S&P 500 25% earnings growth and 8% revenue growth in Q1 2018. Business leaders are feeling optimistic as capital spending growth in Q1 was up around 25%, its highest in seven years, and no doubt influenced by changes in the corporate tax code. Further evidence of...

In April 2018, RMB announced the launch of CryoVault™ (https://www.meissner.com/products/cryovault-freeze-thawplatform). The product, a proprietary, scalable, robust, single-use freeze and thaw platform for the storage of high value biopharmaceuticals, was developed in partnership with Merck. RMB has partnered with Meissner Filtration Products, a leading biopharma equipment supplier, as its exclusive distributor to market the system. The...

March 2017 – Torsion Group Corp (“TGC”) is a manufacturer and distributor of garage door parts and accessories. The company’s unique competitive advantage is its ability to service over 95% of U.S. zip codes in 24 hours–something invaluable when any garage door is having issues. This month, TGC strengthened that competitive advantage by moving into...

February 2018 – Performance Plastics (“PPL”), a world class injection molder of high performance thermoplastic components, added 14,000 sq. ft. to its facility in January of 2018. The additional space will allow the company to improve logistics by consolidating offsite warehousing and facilitate a more efficient manufacturing flow through the plant. This expansion will also allow for...

A line from the 1970 hit single by The Band lamented "oh, you don't know the shape I'm in". In late 2007 it wouldn't have been surprising to hear that comment mumbled from the mouths of a wide swath of US consumers who were straining under the weight of historically high debt service levels. Not...

Warren Buffett once said of investing, "Be fearful when others are greedy and greedy when others are fearful." This contrarian perspective fairly describes my growing unease with the U.S. economy, much like a toddler hearing noises under their bed despite reassurances from their parents (favorable consensus economic forecasts). I can hear the pundits saying, "Mark,...

Cleveland, OH – MCM Capital Partners (“MCM”), a micro-cap private equity firm based in Cleveland, Ohio is pleased to announce the majority acquisition of First Impression Ironworks (“FII” or the “Company”). FII, www.firstimpressionsecuritydoors.com, based in Phoenix, Arizona, is a leading manufacturer and installer of custom ornamental ironwork serving the residential repair and remodel market. The Company boasts...

MCM Capital Partners Sells Portfolio Company Dexmet Corp. Beachwood private equity firm MCM Capital Partners said it generated an “outstanding” cash-on-cash return of about $8 for every dollar invested in its sale of portfolio company Dexmet Corp. MCM Capital bought the company in 2006 and sold it, effective Friday, March 1, to private investment firm...

Cleveland, OH – MCM Capital Partners, a Cleveland, OH based lower middle market private equity fund, is pleased to announce the formation of Torsion Group Corp. (“TGC”), an entity created to acquire niche manufacturers and value added distributors of commercial and residential garage door parts and accessories. TGC has recently completed the acquisition of Action Industries www.action-ind.com (Cleveland,...

We are 27 quarters into the current economic expansion, albeit the weakest on record with a historically low 2.1% average annual GDP growth rate. The average duration and GDP growth rate of prior economic expansions is approximately 6 years (25 quarters) and 4%, respectively, thus it would not be surprising if we are nearing the...

Performance Plastics (“PPL”) is a world class injection molder out of Cincinnati, Ohio. Since its inception, PPL has been focused on solving its customers most challenging manufacturing problems. PPL’s customers rely on the company for its ultra or high performance injection molding thermoplastic expertise, tight tolerances and intricate or thin walled part geometries. The company...

Let's get the bad news out of the way first. Q1 2016 GDP % growth rate was a dismal .8% and is reflective of an economy losing steam as suggested by the downward trend in GDP as presented below: The principal culprit for this weak performance is B2B Industrial output which is being dragged...

Various measures of employment and personal income, while arguably uninspiring for a recovery, point to improving economic health for the U.S. consumer. More specifically, first time jobless claims have maintained a downward slope over the last twelve months and the monthly change in non-farm payrolls has trended up over the last twelve months with recent...

Today, a growing number of small B2B businesses are contributing the majority of their marketing spend to their web presence and our portfolio companies are no exception. A conversation with one in particular has prompted the writing of this blog. RMB Products, a rotational molder and liner of thermoplastic components for demanding applications revised their...

Before addressing our views on the US economy, I wanted to share a brief rant on Greece for which I will apologize in advance. I have been following this Greek tragedy with morbid fascination. In a nutshell, the Greek economy is suffering through a deep recession (aka The Greek Depression) exacerbated by the austerity measures...

Sensors Taking MCM Capital Back to the Future In 1989 Michael J. Fox, as Marty McFly took us "Back to the Future" again. In the sequel to the popular film, Marty travels to the year 2015 where flying cars, time travel and auto-drying clothes were the norm. As we sit here today, some of the...

Effective leadership of small companies is as critical to the national economy as it is to the owners and management of the companies themselves. The key question is: “How to do it well?” Unlike the CEO of a Fortune 500 firm with an army of staff, consultants, the small company president typically has relatively limited human and financial resources.

As one contemplates the strength of current and prospective macroeconomic conditions it is important to discount the feeling of goodwill on Wall St. engendered by a stock market which has proceeded up and to the right since the end of recessionary conditions. In fact, consider from September 30, 2009 to February 28, 2014 the S&P...

As the private equity industry has matured, massive capital inflows and the proliferation of industry professionals has created competition across all segments of the marketplace. As in any industry, over time this competition has diminished both expected and actual returns on capital deployed. The era where astute financial engineering alone is sufficient to generate superior...

Although Q4 2012 ended with a whimper as GDP growth was a microscopic 0.1%; the consensus among 40 economists polled by the Federal Reserve Bank of Philadelphia (those optimistic buggers), was for an accelerating economy in 2013 as follows: Period Consensus GDP Growth Actual GDP Growth Q1 2013 2.1 1.1 Q2 2013 2.3 2.5 Q3...

Last week, I was in Colorado Springs for a board meeting with RMB Products, a MCM Capital portfolio company. During the meeting, the head of Aerospace presented a new case study they authored after delivering a 70% cost savings using their rotationally molded ECS ducting compared to a composite alternative. My colleague and I were...

The great recession hit bottom in Q4 2008, with GDP contracting a whopping 8.9%, followed by 2 subsequent quarters of GDP contraction. The economic recovery began in Q3 2009 as evidenced by 1.4% GDP growth and subsequently the US economy has generated positive GDP growth in each successive quarter through Q4 2012. During this period,...

Eh… granted, not eloquent but an apt description of the current state of our economy. During the second half of 2012 many macroeconomic indicators pointed to a decelerating economic recovery and indeed we saw a slowdown in orders across several of our B2B portfolio companies during this period. This was not unique to MCM Capital...

MCM Recapitalizes Dexmet Corporation, STACI Corporation and StyleCraft Home Collections Cleveland, OH MCM Capital Partners is pleased to announce we have completed three portfolio company recapitalizations. Dexmet Corp, STACI Corp and StyleCraft Home Collections have generated outstanding financial results providing us the opportunity to repatriate capital to our shareholders. Our management teams have done a...

I feel compelled to start this blog with the plea, "Please, don't shoot the messenger". I am not the Grinch, nor do I plan on stealing Christmas, but America may be looking more and more like Whoville without any Roast Beast, Who-hash or presents under the tree should our deficit continue to grow. Putting...

After a 20-year hiatus from the classroom, I recently had the opportunity to reconnect with my most influential professor from graduate school, Dr. Allen Michel. Dr. Michel, an internationally recognized expert on mergers & acquisition related matters and a professor at Boston University Graduate School of Management, asked me to speak to his graduate students...

"In business, I look for economic castles protected by unbreachable 'moats'." -Warren Buffett Warren Buffett has long preached investing in businesses one understood, not only in terms of what the business does but also in terms of the predictability of the long term economics of the industry. Accordingly, in assessing the width of...

A few weeks ago, I read a very interesting and informative blog on leveraging a company's digital footprint post-acquisition and felt our readers might find it useful as well... The following post was written by Brad Miller on August 2, 2012 and republished with permission (M&A's Impact on Digital Marketing – Keeping the SEO Momentum)...

Beginning in 2008, we have been painfully reminded how important a healthy housing market is to our GDP. As a point of reference, new housing starts plummeted a whopping 77% from a peak of 2.5 million new units in 2005 to a paltry 583,000 units in 2009. New housing starts in 2010 (605,000 units) and 2011...

"If you don't go to somebody's funeral, chances are, they won't come to yours." —Yogi Berra Sounds pretty morbid, but it's the truth. As Yogi Berra so eloquently put it, relationships require a quid pro quo. In a previous blog I had challenged the reader to begin to think about relationship building as "farming" rather...

As a CEO, wouldn't it be nice to be able to instantly access sales margin information to better forecast next month's profitability, determine whether you should run a sale on certain items to hit year-end sales figures or instantly see how your new sales representative is performing in Louisville... all while you may be half...

Driving into to work this morning, I was listening to CNBC's Squawk Box which, on this particular morning, featured a well-respected financial advisor providing his long term insights on the economy and equity markets. To summarize, he projects tepid GDP growth for the next several years and by extension, believes this will correlate with modest...

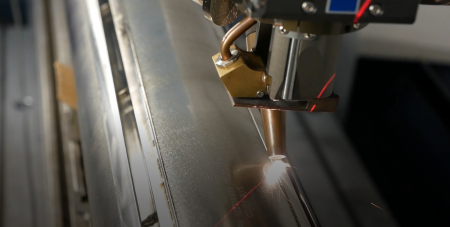

Dexmet has brought the capability of Wire EDM (Electrical Discharge Machining) technology in-house to quicken the development process and provide better turnaround time to its customers. The new capability will allow Dexmet to quickly generate custom expanding dies for application specific expanded products or provide custom cut geometries out of already expanded materials. The engineers...

I have become a bit fatigued with the stream of bad economic news (European debt crisis, fiscal deficits, blah, blah, blah) seemingly taking permanent residence in the Wall Street Journal. Consequently, I am choosing to start this macro-economic perspective with a little bit of sunshine by reminding ourselves the commercial climate isn't all that bad....

STACI Corporation Electronics Manufacturing Services facility receives Supplier of the Year Award from Southco Gurnee, IL – STACI Corporation announces that they have received the Supplier of the Year Award from Southco. STACI was one of a few hundred suppliers under consideration for this most coveted of supplier awards. There were a total of 12 suppliers that had...

MCM Announces Acquisition of Zinkan Enterprises CLEVELAND, OHIO - MCM Capital Partners ("MCM"), is pleased to announce its investment to fund the majority recapitalization of Zinkan Enterprises Inc., a manufacturer and value added distributor of specialty chemicals serving mining, industrial and commercial customers. Senior financing was provided by Key Bank. Founded...

MCM Capital would like to thank each and everyone of you for taking the time to read our blog and post very insightful comments over the last year and half. We hope you have enjoyed reading them as much as we have enjoyed writing them and hope they have been both informative and interesting...

Referral marketing is sometimes considered one of the simplest and least glamorous types of marketing. However, when utilized correctly it can result in remarkably high close rates with an extraordinarily high return on investments. The internet and social media outlets, where communication travels freely (and instantly), is forcing companies to re-think how they utilize this...

Recently I attended the wedding of my wife's nephew, David and his beautiful bride, Kerry. It was great fun watching David, while standing at the alter awaiting his bride, mouth a "wow" to his family upon seeing his stunning bride enter the church and walk down the aisle. Appropriately, the service was uplifting and featured...

Investing in companies with subsidiaries in China creates challenges and obstacles not prevalent in the United States. Local customs, culture, labor law, commercial law, and taxation, but to name a few, are significantly different as is the challenge of financing middle market companies operating abroad. Over the years, we have been involved with several businesses...

Four years ago, I joined the Alliance of Merger & Acquisition Advisors® (AM&AA), a trade organization bringing together investment bankers, private equity professionals, CPAs, attorneys and other corporate financial advisors for educational and networking purposes. This past month, AM&AA held its Summer Conference in Chicago which included over 400 M&A professionals discussing various topics ranging from valuation...

My fellow associates and I began writing a weekly blog over one year ago which we publish regularly each Wednesday. Blog topics fall into one of four categories: Business Best Practices, General Economic Conditions, PE News, and MCM News. Four of us blog (we excused Kevin, our CFO because he actually has real work to...

"Beware of geeks carrying calculators" ~Warren Buffet Most finance majors at MBA programs during the 1980's, were introduced to Modern Portfolio Theory. We were taught about efficient markets and introduced to the Random Walk notion that stock prices in the public markets were efficient and factored in all available information such that their purchase or...

"The greatest accomplishment is not in never falling, but in rising again after you fall." ~ Vince Lombardi ~ As a microcap LBO fund with a twenty year investment history we have had our fair share of great deals, good deals, average deals, and then those where selective amnesia comes in handy. In an industry...

OK, I admit it. I was thrilled to watch LeBron and his Miami Heat "team" self-implode during the 2011 NBA finals. Interestingly, I was not alone seeing that an ESPN poll showed that 49 states in the U.S. wanted to see Dallas beat Miami. The lesson we all learned during this year's NBA finals is...

Let me preface this blog with the fact I am neither an economist nor a meteorologist, but based on certain macroeconomic indicators and discussions with our portfolio CEO'S, sense economic storm clouds looming on the horizon. My opinion flies in the face of our portfolio performance, which taken as a whole, has been strong to...

Come and listen to a story about a man named Jed A poor mountaineer, barely kept his family fed, Then one day he was shootin at some food, And up through the ground came a bubblin crude. Oil that is, black gold, Texas tea. For those not familiar with the Beverly Hillbillies, a 1960's...

A few weeks ago on my way back from Denver, I was sitting in my comfortable coach seat (thanks to the merger) with a reclined chair falling in my lap carefully trying to maneuver the marketplace section of the Wall Street Journal to read an article having caught my eye. Its title "For Lean Factories,...

CEO's are constantly under pressure to drive profitability by growing sales. Sales growth initiatives typically involve introducing new products or services, increasing market share, more deeply penetrating existing customers, entering new markets (i.e., extending distribution to new geographies), changing sales mix and/or raising prices. Not all of these sales levers are created equally, a lesson...

Ten years ago, Jim Collins released Good to Great: Why Some Companies Make the Leap…and Others Don’t. In developing his thesis, Collins and his research team identified a group of companies which went through transformational periods and made the leap from mediocrity to sustained long term superiority lasting at least 15 years. This group of...

On behalf of our entire team at MCM Capital we would like to wish everyone peace, happiness, prosperity, and all the joys of this Holiday Season. We appreciate you taking the time to come to our site and read our blogs. We hope you have enjoyed reading them as much as we have enjoyed writing them...

Even with improved corporate earnings and a healthy manufacturing output our CEO’s remain vigilant in managing controllable expenses to combat inflationary raw material costs. In facing these challenges chief executives from MCM Capital Partners portfolio companies came together to listen, learn, and better understand how to increase revenue and continue to build shareholder value in our...

News Flash: Globalization, inclusive of the rise of low cost country ("LCC") sourcing, is reshaping US manufacturing. OK, maybe the aforementioned is not a groundbreaking revelation, but it is worthwhile to explore in a little more detail and elucidate the impact of globalization and the proliferation of LCC sourcing on US manufacturing and more specifically...

For the past five years China has been a darling amongst investors. China has growth, size, an awakening entrepreneurial spirit and a one party government, that in stark contrast to the U.S. Congress, seemed to get things done. But lately investors have seen the China glass as being “half empty”. So what has changed and...

As you are aware, President Obama signed into law on December 17, 2010 The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010. This Act has very favorable income tax and wealth transfer tax provisions, including a reduced maximum estate tax rate of 35% (from 55%) and a five-fold increase in the lifetime...

Over the past few years, much has been written on the impact of the internet and social networking websites as a medium for business development and their impact on the globalization of the world economies. Interestingly, the social media sites have been highlighted for their role in geopolitical developments in the Middle East....

First the good news...Corporate earnings have been good to great and manufacturing output remains healthy; The PMI has remained well north of 50, reflective of an expansionary manufacturing economy, for 18 consecutive months through January 2011. In fact the PMI hit 61 in January, its highest level since May 2004. Our portfolio, being largely manufacturing...

I have been reading the fascinating and informative Warren Buffett biography, “Snowball”, which does a wonderful job of profiling his career and investment approach. The book recounts Buffett spending countless hours pouring through Standards & Poor’s financial reports in the early 1960s trolling for ignored, undervalued companies (“unloved cigar butts”) trading at discounts to book...

With health care costs soaring (rapidly approaching 20% of the nations GDP) and businesses seeking ways to become more profitable, every CEO is desirous of lowering health care costs, pharmaceutical claims and short and long-term disability claims. There are numerous strategies to lower health care costs ranging from the unpopular reduction in coverage amounts to asking...

“What you are shouts so loudly in my ears I can’t hear what you say” ~Ralph Waldo Emerson~ The sale or leveraged recapitalization of your business will likely represent the single most important financial and business decision of your lifetime. Choosing the right advisors to represent you is second only to choosing the right private...

Our investment interest in the medical device market is predicated upon several macro-economic drivers including device innovation, favorable demographics, and hospital austerity. Researcher’s believe these key factors will drive the global medical device market to over $300 billion this year. Analysts presage a $312 billion medical device market in 2011 and forecast roughly 4-6% growth for...

Part II – Incentive Based Compensation Incentive programs are one of the few business strategies in which cost can be based on actual performance and paid out after the desired results have been realized. The right incentive program can motivate ordinary people to do extraordinary things and help reduce turnover, boost morale and loyalty, improve...

Move to increase circuit board-maker’s staff by 40 Inservco Inc., a LaGrange company that makes printed circuit boards, has acquired a New Jersey concern to expand its East Coast presence, and as a result, the company plans to add 40 jobs at its Lorain County headquarters. Inservco, which is part of private equity firm MCM...

Before we start on “what to do”, let’s talk about “why we do it”. Variable compensation can be used for any combination of the following reasons: Align employee financial return with company financial performance; Encourage specific patterns of behavior among employees; Share the “fixed cost risk” of compensation between employee and employer. For the purposes...

“MCM Capital is a group of very capable, very down to earth people we’re proud to work with.” Ed Pentacost Chairman and CEO National City Equity Partners

“We enjoy good chemistry with MCM, good collaboration of resources to get the deals done.” Mike McHugh GMB

“There are a lot of private equity firms you could look at – but once you meet the guys at MCM, you know this is who you want to work with.” Dennis Docherty President, CEO Inservco

“MCM impressed me right from the start how quickly they move to complete the deal – and how seamless the transaction was.”

“The pros at MCM are up front with you at all times, easy to work with. And they let you run your business.” Jimmy Webster President, CEO Stylecraft

“I like the leadership of MCM, the teamwork of Steve, Jay, Mark and others on their staff. We definitely made the right move with MCM” Bob Merckle President, CEO ESSCO

CLEVELAND, OHIO – As a result of a dedicated search effort, MCM Capital Partners (“MCM”), has teamed with Mr. Craig Jack, a talented executive, and the incumbent management team led by its principal shareholder, Mr. Randy Gardiner to recapitalize RMB Products (“RMB”), a niche manufacturer of engineered, high performance thermoplastic products and solutions for demanding...

MCM Capital would like to thank each and everyone of you for taking the time to read our blog and post very insightful comments over the last five months. Our blog will be on hold and our posts will continue after the first of the year due to the hectic Holiday Season. We hope you...

Many misconceptions about private equity persist. They stem from the industry's nascent years in the 1980s when firms would buy companies using a great deal of leverage, strip their assets, break them apart, add little (or no) value, and make over-sized returns. Movies such as "Wall Street", "Other People's Money", and even "Pretty Woman" helped...

Mr. McGuire: I want to say one word to you. Just one word. Benjamin: Yes, sir. Mr. McGuire: Are you listening? Benjamin: Yes, I am. Mr. McGuire: Plastics. Benjamin: Exactly how do you mean? Mr. McGuire: There is a great future in plastics. Think about it. Will you think about it? The above lines were...

The Chinese proverb “may you live in interesting times” has been particularly true during the past few years. Harken back to November, 2007 and the DJIA (Dow Jones Industrial Average) which peaked the prior month began its precipitous 50% decline and by November 2008, the world economy was on the brink of collapse. This November...

For many small business owners, selling a business represents the culmination of their entrepreneurial career. You have built your business from the ground up and now it's time to slow down and enjoy the fruits of your labor. You are ready to make the transition from understudy to lead role and play the part of Rod...

As I deplaned last week in Chicago along with 20 other private equity professionals sporting navy blue blazers with freshly pressed trousers, a gallery of ready to board passengers watched patiently as the herd of early flight businessmen paraded by. Most of us, if not all of us were heading to the Association for Corporate Growth...

I had a remarkable experience (at least to a man of, ahem, my technical virtuosity) communicating with Erin, my daughter, who is studying this fall at the University of Dublin. I called her, at no cost, via Skype and we had a nice, long video chat. The video feature significantly enhances our feeling of connectedness...

Famed martial artist, Bruce Lee pioneered a martial arts philosophy coined “Jeet Kune Do”. During his years of perfecting his martial arts skills he recognized the strengths and limitations of the many traditional martial arts disciplines (Karate, Tae Kwon Do, Kung Fu, Boxing etc.). He believed the purist mentality of each of the disciplines detracted...

As I was responding to posts on my personal Facebook page last week I began to contemplate the impact social media has had on our lives. Become a Fan, Like Us, Follow me, Friend me, Tweets, Posts, Tagging, News feeds, Status updates, it seems that’s all kids are worried about these days. Then I balked at...

Where do you go when you need to purchase a replacement part for your Toshiba XT90CA printer, find a vacuum repair shop, or find an equity partner if you were seeking a liquidity event via the sale of your privately-held business? If you live in a third world country or it were 1987, your answer may be...

Since MCM’s inception in 1992 the world has become much smaller with the rapid emergence of the BRIC (Brazil, Russia, India, and China) countries, particularly China and India. Several factors converged to change this landscape rapidly over the past decade. First, China’s admission into the World Trade Organization led the way for political and economic...

As I struggled with insomnia a few weeks ago, sweating out where the economy was headed, the new carried interest tax proposals, and the Dodd-Frank (aka Fin-Reg) bill, I dreamt I heard Barney Frank's voice quip “Fannie May and Freddie Mac are not in a financial crisis…..The more people exaggerate these problems, the more pressure...

CEO's of MCM's portfolio companies are constantly faced with the extraordinary challenges of growing revenues and building shareholder value. To support our team's efforts, MCM launched its inaugural Annual CEO Summit in 2005. This two-day event culminates in our portfolio company senior executives listening, learning, and sharing their operational practices with industry experts in different fields. MCM's Annual CEO Summit...

I entered the Leveraged Buyout Industry during the mid 1980’s working with a couple of entrepreneurs who were focused on acquiring businesses in the automotive industry. It was a tough industry then and it’s a tough industry now, and one at MCM we typically avoid. In a Darwinian way, it forced the survivors of the...

The hotly debated Dodd-Frank financial regulatory reform bill ("Fin Reg") finally became law on July 21st representing a complete paradigm shift in the American financial regulatory environment. The Wall Street Journal called it “the most sweeping overhaul of U.S. financial-market regulations since the Great Depression.” The bill itself was, a back breaking, mind bending, 2,300 pages...

For a former professional baseball player with a degree in finance from Fordham University, the term private equity sounded like the name of a long shot at the Belmont Stakes. However, a number of former professional athletes have taken the reigns and jumped in the private equity saddle. I am not afraid to admit my...

As a Midwest-based micro-cap private equity firm, we strive to add value to our portfolio companies by sharing best practices amongst our various management teams. For example, Cole Information Services in Omaha, a nationally-recognized lead generation business, was the first to leverage cost efficient on-line customer surveys on a quarterly basis. ESSCO, another MCM portfolio company, a niche distributor of vacuum cleaner parts...

“It was just a flesh wound. " For those of you not Monty Python fans, this quote was uttered by the Dark Knight after losing both arms in a sword fight and is an apt description of our economy for the past 24 months. This recession has been longer and deeper than any since the Great...

Solid Investor Returns Generated; Company Positioned for Future Growth January 2010 CLEVELAND, OHIO – MCM Capital Partners (“MCM”), a Cleveland, Ohio-based private equity firm and a leading investment firm dedicated to investing in microcap private businesses generating up to $75 million in annual revenues, has completed the sale of Amrep, Inc. (“Amrep”), a Marietta, Georgia-based...

ELECTRIC SWEEPER SERVICE COMPANY COMPLETES ACQUISITION OF SUBSTANTIALLY ALL ASSETS OF STAR EQUIPMENT AND SUPPLIES Enhanced Sales and Distribution Capabilities Position Company for Further Growth September 2009 VALLEY VIEW, OHIO – The Electric Sweeper Service Company (“ESSCO”), a MCM Capital Partners portfolio company and the nation’s leading wholesaler of vacuum cleaner parts and vacuum cleaners...

MCM CAPITAL PARTNERS ACQUIRES STYLECRAFT HOME COLLECTION AND PLANS AGGRESSIVE, TOP-LINE GROWTH Expansion Eyed in Multiple Markets July 2009 CLEVELAND, OHIO – MCM Capital Partners (“MCM”), a Cleveland, Ohio-based microcap private equity firm dedicated to investing in microcap private businesses generating less than $75 million in annual revenues, has acquired StyleCraft Home Collection, Inc. (“StyleCraft”),...

STACI Corporation Electronics Manufacturing Services Facility in China Certified to the TS 16949 Automotive Quality Standards Gurnee, IL – STACI Corporation announces their successful certification to TS 16949, which is an automotive quality standard that is required to serve the automotive market. The state-of-the-art facility is located in an industrial park in Dongkeng, Guangdong province,...

Top Reference and Lead Generation Provider Poised for Expansion March 2008 CLEVELAND, OHIO – MCM Capital Partners (“MCM”), a Cleveland, Ohio-based private equity firm and a leading investment firm dedicated to investing in microcap private businesses generating up to $75 million in annual revenues, is pleased to announce its acquisition of Cole Information Services (“Cole”),...

MCM Capital Partners II Acquires Niche Specialty Materials Manufacturer Dexmet and Plans Aggressive, Top-Line Growth New Company Chairman Sets Sights on Doubling Revenues Within Five Years September 2006 CLEVELAND, OH – MCM Capital Partners II (“MCM”), a Cleveland, Ohio-based private equity firm and a leading investment firm dedicated to investing in small cap leveraged buyouts...

Transaction Positions Management to Pursue Strategic Growth March 2006 CLEVELAND, OH – MCM Capital Partners II (“MCM”), a Cleveland, Ohio-based private equity firm and a leading investment firm dedicated to investing in the lower middle market, is pleased to announce its acquisition of STACI, a rapidly growing global provider of engineering, outsourcing and supply chain services...

MCM Capital Partners II Acquires Electric Sweeper Service Company And Plans Rapid Expansion Transaction Positions Incumbent Management to Pursue Aggressive Growth September 1, 2005 CLEVELAND, OH – MCM Capital Partners II (“MCM”), a Cleveland, Ohio-based private equity firm and a leading investment firm dedicated to investing in businesses generating up to $100 million in annual...

MCM Capital Generates Strong Return on Sale of MicroGroup, Incorporated Significant Capital Investments Boost Company Profits, Yield Strong Investor Returns August 12, 2005 CLEVELAND, OH – MCM Capital Partners, a Cleveland, Ohio-based private equity firm and a leading investment firm dedicated to investing in smaller middle-market businesses, announced the successful completion of its sale of...

MCM Capital Partners Announces Initial Closing Of Second Private Equity Fund Top Quartile Performance Sets Stage For Smaller Middle-Market Acquisitions October 2004 CLEVELAND, OH – MCM Capital Partners, a Cleveland, Ohio-based private equity firm and a leading investment firm dedicated to investing in smaller middle-market businesses, is pleased to announce the initial closing of MCM...

MCM Capital Realizes Top-Quartile Return In Sale Of Stylecraft Home Collections MCM Capital Partners announced today that they have sold Stylecraft Home Collections to Linsalata Capital Partners. The Fund realized over 4 times its investment in StyleCraft, generating an annual compounded return exceeding 60%. MCM, in partnership with management, originally acquired the business in 2001....

MCM Capital Partners., L.P. Sells OMCO Corporation June 19, 2003 Cleveland, Ohio – On June 19, 2003, MCM Capital Partners, L.P., (“MCM”) a private equity firm based in Cleveland, Ohio, sold The Ohio Moulding Corporation (“OMCO”), headquartered in Wickliffe, Ohio, to an undisclosed buyer. The transaction was completed in November 2000 in the form of...

MCM Capital Partners, LP (a Cleveland based leveraged buyout fund) is pleased to announce the acquisition of MicroGroup, Inc, a Massachusetts based provider of medical grade stainless steel tubing, miniature valves and fittings and precision machining and assembly services. The acquisition was made in partnership with National City Equity Partners (the private investment subsidiary of...

MCM Capital Partners LLC and Huron Capital announced today that they have recently co-sponsored the acquisition of Stylecraft Lamps, Inc. (“Stylecraft”) along with Jimmy D. Webster, Jr., Stylecraft’s CEO. The purchase price for Stylecraft was not disclosed.Founded in 1968 and based in Hernando, Mississippi, Stylecraft designs, manufactures and markets over 700 SKU’s of traditional-style consumer...

On December 1, 2000, MCM Capital Partners, L.P., a private equity firm based in Cleveland, Ohio, in partnership with management completed the recapitalization of The Ohio Moulding Corporation (“OMCO”), headquartered in Wickliffe, Ohio. OMCO (www.omcoform.com) is one of North America’s leading manufacturers of roll-formed structural carbon and stainless steel products in North America. OMCO’s core...