A Glimmer of Sunshine

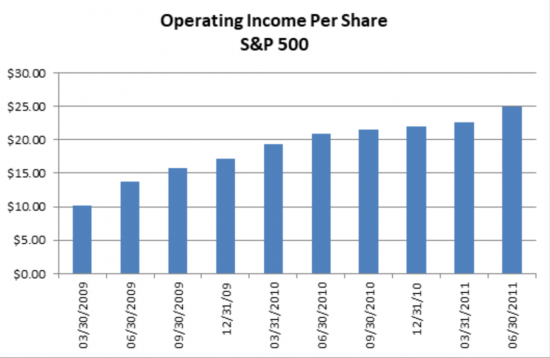

I have become a bit fatigued with the stream of bad economic news (European debt crisis, fiscal deficits, blah, blah, blah) seemingly taking permanent residence in the Wall Street Journal. Consequently, I am choosing to start this macro-economic perspective with a little bit of sunshine by reminding ourselves the commercial climate isn’t all that bad. For example, quarterly earnings, as measured by the S&P 500, have steadily improved since the dark days of Q1 2009 as detailed below.

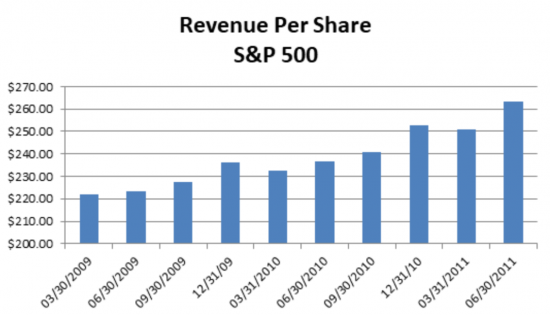

Although corporate America has vigilantly controlled cost to drive earnings, it is important to note revenues have been growing as well as detailed below:

I am pleased to report the above charts are reflective of our portfolio companies, many of which are achieving strong, if not record profitability.

Unfortunately, there seems to be a disconnect between company earnings and the labor market, which has not materially improved (not including seasonal hires for the Holidays) from its nadir in October 2009. The U.S. unemployment rate is hovering around 9%, as detailed in the graph below, essentially unchanged for the past several months.

I believe the productivity gains made during the recession are playing a substantive role in damping the need to add employees. Although the impact of productivity gains on manufacturing employment appears to be more extreme this cycle, it is consistent with prior recessions, a topic I blogged about (Globalization Shapes US Manufacturing) this past April. In our opinion, the weak labor market, coupled with an annualized 3.9% increase in the seasonally unadjusted CPI, will continue to stress the consumer and temper domestic economic growth.

For more information on our small cap buyout fund and investment principles, contact us today.