This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

“What is the value of my business?” This is a common question asked by business owners for estate planning or retirement purposes since, in many cases, most of their wealth is tied up in their company. Establishing a company’s true value requires soliciting bids from qualified buyers. However, short of putting your company up for sale, this article describes a relatively simple means of approximating the value of a private company.

The total fair market value of a business is often called the company’s Enterprise Value, or the sum of its market value inclusive of debts, minus its cash and cash equivalents. Valuation methods for calculating Enterprise Value include, but are not limited to, discounted cash flow (DCF) analysis, using public company share prices, or applying recent industry transactions of comparable companies. A valuation approach commonly used by private equity and investment banking professionals, and the one we will focus on here, applies a multiple to Earnings Before Interest, Taxes, Depreciation, and Amortization (“EBITDA”).

What EBITDA Multiple Should I Use For Calculating Enterprise Value?

The majority of businesses generating between $10 million and $75 million of annual revenue historically transact for EBITDA multiples between 5.0x and 8.0x EBITDA. The EBITDA multiple applied to a particular private business is a function of a potential buyer’s view of it’s risk-return profile. Consequently, a company’s Enterprise Value is also dependent on the factors outlined below.

The appropriate EBITDA Multiple in calculating Enterprise Value is influenced by numerous factors including, but not limited to, level of customer concentration, company and industry growth rates, supplier concentration, competitive position, profit margins, size of the company and depth and strength of the management team. Such factors need to be assessed individually and considered in totality when valuing private companies. For example, customer concentration (e.g., single customer > 20%) often dictates a lower EBITDA Multiple. Conversely, companies with little customer concentration participating in attractive end markets with high growth rates such as medical or aerospace, or utilizing unique materials or processes, typically command higher than average EBITDA multiples. A potential buyer will also want to gauge management’s estimate of capital expenditures required for supporting growth of the business on a go-forward basis.

What EBITDA Will Be Used In My Private Company Valuation?

It is common practice to utilize the most recent trailing twelve months EBITDA in calculating Enterprise Value, albeit in certain circumstances it may be more appropriate to use an average EBITDA of the last 2 or 3 years. For example, small businesses may experience temporary spikes or dips in EBITDA due to a myriad of customer, market, or macroeconomic issues. Smoothing these outliers often provides a more accurate reflection of company value.

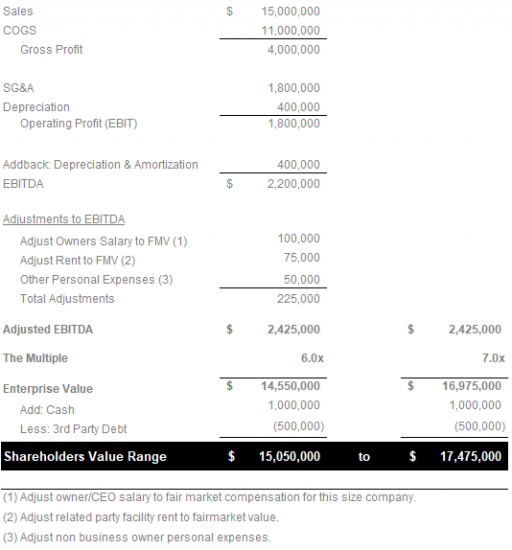

Further, it is common practice to normalize EBITDA, resulting in an Adjusted EBITDA. Some common adjustments to EBITDA include, but are not limited to, non-recurring revenues and expenses (litigation expenses, changes in accounting methods, facility moves, certain professional fees, etc.), non-business/personal-related expenses (car leases not used in business, payments to family members outside the business, country club memberships, etc.), facility rent and/or owner compensation above or below fair market value. Alternatively, some EBITDA adjustments likely not accepted by a potential private equity or strategic buyer may include, ineffective marketing campaigns, research and development expenses related to failed product launches or bonuses paid annually but considered “discretionary.”

Understanding the Difference Between Enterprise Value and Shareholders Value

The product of using an appropriate EBITDA multiple results in a realistic estimate of Enterprise Value, not to be confused with Shareholders Value. Since businesses typically transact on a cash-free, debt-free basis, Shareholders Value is calculated as the Enterprise Value (EBITDA Multiple x Adjusted EBITDA) plus cash and cash equivalents minus third party debt (bank debt and capital leases).

The following example illustrates how to calculate Enterprise Value using the Multiple of EBITDA method from the foregoing concepts:

Other Common Private Company Valuation Methods: Asset Based, Discounted Cash Flow, Market Value

While the foregoing method for calculating Enterprise Value as a multiple of EBITDA, determined by a myriad of business factors is most relied upon in private equity and investment banking, it is not the only valuation method for private companies.

- Asset Based Valuation Method: This approach examines the company’s balance sheet, subtracting the value of its total liabilities from the company’s total net asset value. There are two approaches to an asset based valuation:

- Going Concern Approach: If the business plans to continue operating without immediately selling any assets, it should use the going-concern approach to asset based business valuation.

- Liquidation Value Approach: Conversely, if the business is winding down, it should apply the liquidation value asset based valuation method. Here, the value is based on net cash that would exist if the business terminated and sold off the assets. Predictably, this approach often yields a valuation below fair market value.

- Discounted Cash Flow (DCF) Valuation Method: Also referred to as the income approach, the DCF valuation method relies more on a company’s financial information. This enables one of DCF’s key advantages over other valuation techniques: it evaluates companies on an absolute basis, removing subjectivity. DCF values a business based on its projected cash flow over an appropriate period of time, adjusted to present value using a realistic discount rate.

- Market Value Valuation Method: This method compares a business to similar companies. Ideally, a company would use financial information from precedent transactions to arrive at an accurate valuation. As mentioned at the beginning of this article, some business owners turn to market capitalization data on public companies in their industry to try to extrapolate a value for their companies based on industry averages. A word of caution: this method fails to take into account differences in capabilities, projected growth rates, intangible assets, and other relevant factors. At best, an upward trend in industry average market capitalization for public companies may indicate a strong growth rate for the market as a whole.

Next Steps For Private Company Valuation

This article has provided the framework for estimating a private company’s Enterprise Value. As stated previously, the true value can only be established by soliciting bids from qualified buyers. However, it is possible to provide a reasonably close approximation of Enterprise Value with the help of a qualified professional who can assist in identifying and quantifying critical valuation factors.

The next article explores our view on critical factors affecting Enterprise Value including:

- EBITDA

- Revenue Trends

- Profit Margins

- Customer Concentration

- Industry Growth Rate

- Strength and Depth of the Management Team

- Competitive Advantages

MCM Capital is a Cleveland, OH based lower middle market private equity fund focused on acquiring niche manufacturing and value added distribution businesses generating $10 million to $75 million in annual revenues.