This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Driving into to work this morning, I was listening to CNBC’s Squawk Box which, on this particular morning, featured a well-respected financial advisor providing his long term insights on the economy and equity markets. To summarize, he projects tepid GDP growth for the next several years and by extension, believes this will correlate with modest equity market performance. Whether his insights prove prescient or not, it prompted me to consider the favorable dynamics of smaller companies making up the Microcap LBO market, MCM’s target market for the last 20 years.

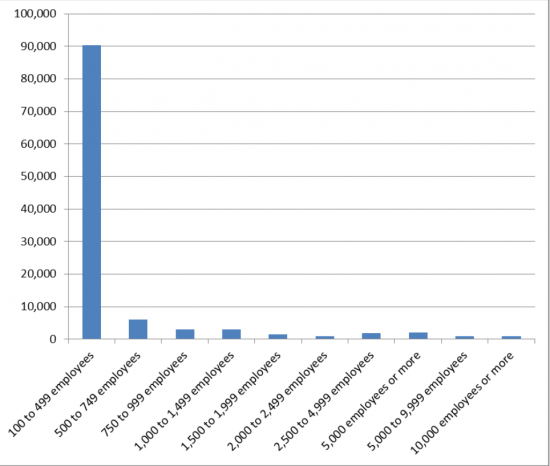

We define the Microcap LBO market as companies with enterprise values of $15-$50 million, typically generating revenues of $15-$75 million and EBITDA of $2-$8 million. As one might intuitively expect the population of companies falling into this category are far greater than the number of larger companies as indicated by the following chart:

Number of Companies by Employment

Source: US Census Bureau 2008

In addition to the greater number of investment opportunities, generally purchase price multiples are lower reflecting the law of supply and demand. The aforementioned are attractive attributes; however, our fondness for the Microcap market has more to do with the opportunity small companies afford us to positively affect revenue and earnings. Typically, it is relatively easier to achieve the same percentage growth rate of a smaller company than in a larger company (authors’ note: this rule apparently does not apply to Apple). Further, in a Microcap company small changes in personnel and or tactics can profoundly impact earnings. For example, we purchased Dexmet, a $2.5M EBITDA company in August, 2006 which at the time of acquisition derived over 80% of its revenues from the lithium polymer battery market. We introduced a new CEO with a mandate to invest in new product and business development initiatives. The Company has since doubled EBITDA and serves a significantly more diverse customer base with battery applications representing only 40% of total revenues.

Of course, the ability to materially impact earnings can be both a blessing and a curse, hence portfolio management rule Number One within MCM is “Do no harm”. This rather simplistic adage speaks to our approach of gaining an intimate understanding of a newly acquired portfolio company’s strengths, weaknesses, market dynamics, etc. before advocating for changes. For example, in performing due diligence on MicroGroup, a former portfolio company acquired in 2001, I underestimated the talents and value added of the Company’s COO, who lacked the polish one usually associates with C-Level executives. This was particularly worrisome given the fact the CEO, although creative, was quite eccentric (“just call me Crazy Bill”), and thus she had more authority and impact than a typical COO. However, over the first year and thankfully throughout our ownership, I came to admire her New England common sense, passion for the company and ability to lead. In no small part, she was responsible for creating a culture which embraced lean manufacturing principals embodied in the Company’s motto of “Do it Right, Do it Fast”. The company truly excelled at providing best in class fulfillment of complex machined miniature medical device components and assemblies, often turning an order around in days as opposed to the weeks typical of their competitors.

Conventional wisdom suggests Microcap companies, relative to larger organizations, are more fragile presenting a smaller margin for error and, as a gross generalization, I would agree. However, our experience has been contrary to conventional wisdom. From 1998 through 2011, we have led 15 LBOs of Microcap companies, eight of which are current holdings. During this period we have not realized a loss on any single LBO investment and have only one small “mark to market” loss on an existing portfolio company. I believe our positive experience investing in the Microcap market is attributable to sound investment strategies enhanced by a strong Board of Operating Partners, coupled with almost 20 years of working with entrepreneurs and Microcap sizes companies. We remain bullish on the Microcap LBO market and fervently hope it remains under-served by the broader private equity community.

For more information on our Microcap buyout fund and investment principles, contact us today.